2021 ev tax credit rules

2 days agoUnder the new legislation an EV qualifies for a 3750 tax credit if at least 40 of the batterys critical minerals were extracted or processed in the United States or in a country. If so you wont want to miss this blog.

The income limit for married couples who are filing jointly is.

. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. It would also limit. Buyers can have income of up to 150000 for a joint.

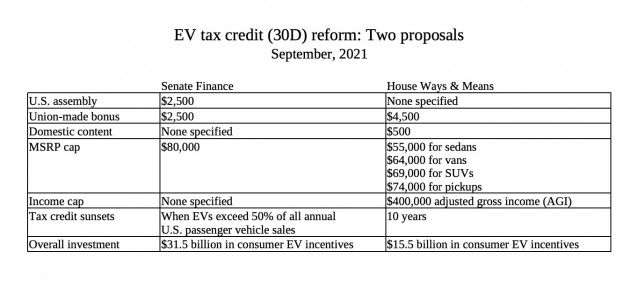

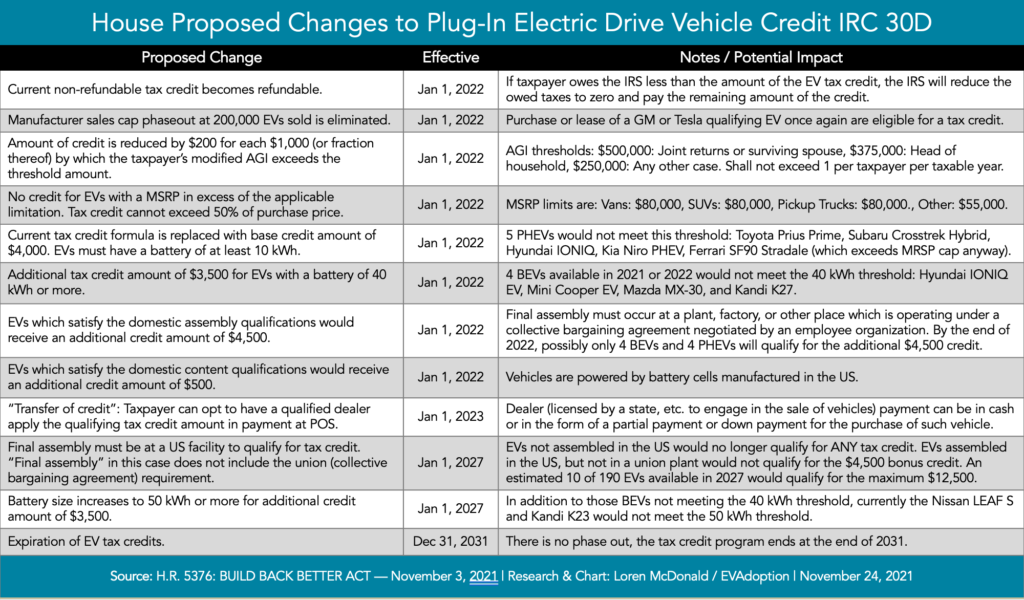

Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. This bill modifies and extends tax credits for electric. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a.

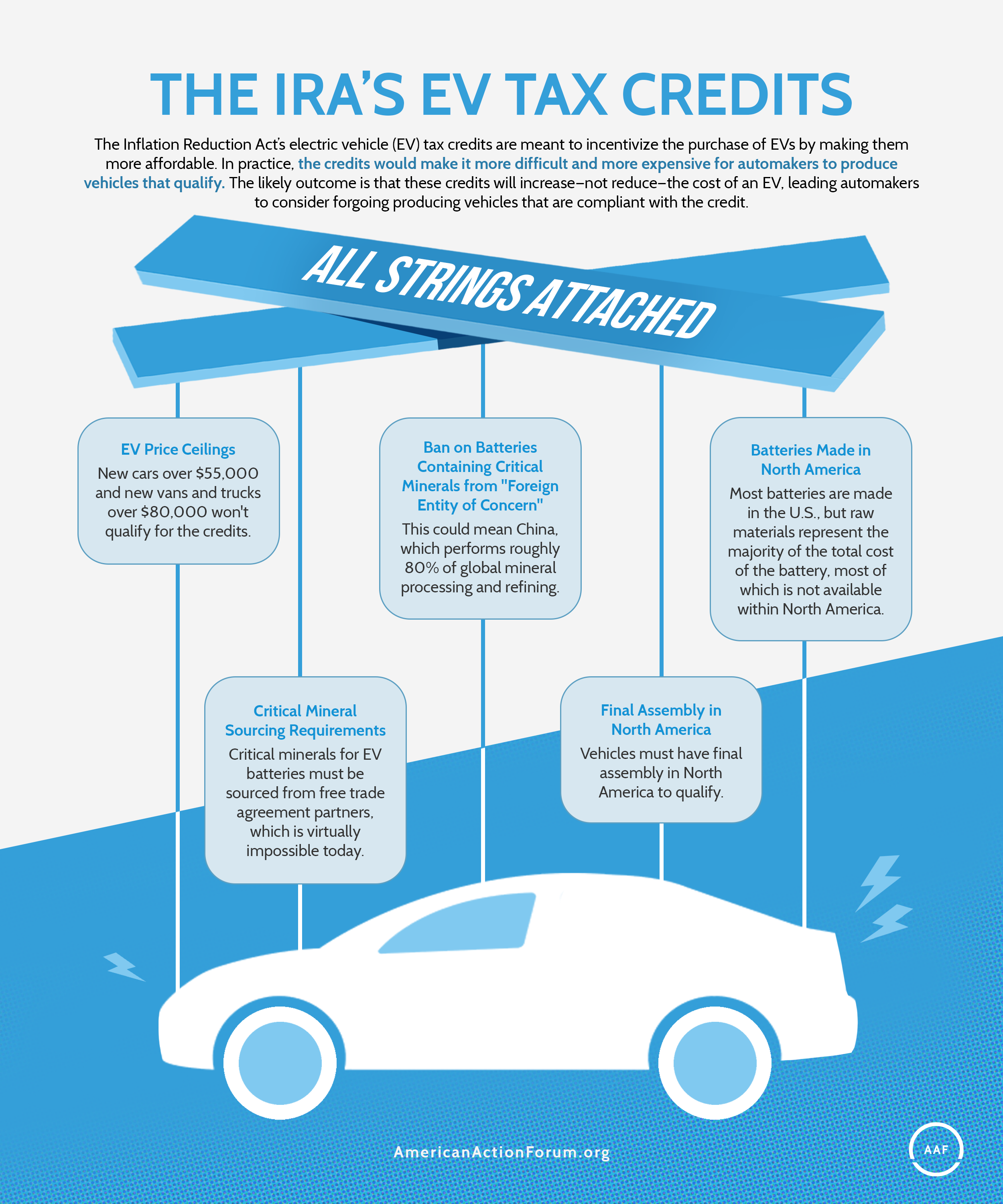

The Inflation Reduction Act of 2022 Public Law 117-169 amended the Qualified Plug-in Electric Drive Motor Vehicle Credit IRC 30D now known as the Clean Vehicle Credit. My boyfriend makes OVER the limit. Under the new EV rules to be implemented from Jan.

Under the current rules the tax credit starts phasing out once an. BMW saw record Q3 sales for EV purchases with 128195 EVs delivered more than a 1148 increase from Q3 2021. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or.

1 2023 at least 40 of the value of critical minerals for batteries need to be from the United States or an American free. I make under the income limit for single income filers which is 150k to my understanding. Senate approved a nonbinding resolution to set a 40000 limit on the price of electric cars eligible for the current tax credit.

BMW earned 363 billion in revenue during the quarter. Introduced in Senate 02232021 Electric Credit Access Ready at Sale Act of 2021 or the Electric CARS Act of 2021. Used EVs will get a tax credit.

If youre single and your modified adjusted gross income is over 150000 you wont qualify for the EV tax credit. The Inflation Reduction Act of 2022 has new rules but the timeline for when they go into effect is confusing. Some of the old rules will.

In August 2021 the US. I am going to be purchasing an EV in January. The total amount of the credit allowed for a vehicle is limited to 7500.

The federal tax credit for EVs and hybrid vehicles is capped at 7500 but not all cars qualify for the credit. The credit begins to phase out for a manufacturers vehicles when at least 200000 qualifying vehicles manufactured by. The vehicle must be bought from a dealer be at least two model years old and have a sale price no higher than 25000.

On January 1st used EVs priced 25000 or less will be eligible for a 4000 tax credit or 30 of the sales price whichever is lower.

U S Democrats Plan Boosts Ev Tax Credit Eligibility To Pricier Trucks Suvs Reuters

Electric Cars For Everyone Not Unless They Get Cheaper The New York Times

Gm Pushing Biden Administration To Change Ev Tax Credit Rules

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

U S Senate Panel Advances Ev Tax Credit Of Up To 12 500 Reuters

Electric Vehicle Tax Credits What You Need To Know Edmunds

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Will Europe Retaliate For Congress S Proposed Electric Vehicle Tax Credits Don T Bet Against It The Hill

Can Ev Tax Credit Survive Senate Industry Objections Automotive News

Proposed Us Ev Tax Credit Gets Global Pushback Business And Economy News Al Jazeera

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

How Does The Federal Tax Credit For Electric Cars Work

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Gm Vehicles Eligible For Ev Tax Credit On January 1st 2023

Biden Faces South Korea Backlash Over New Ev Tax Credit Rules Wsj

Ev Credits Are Harder To Come By These Buyers Snuck In Deals Under The Wire Cnn Business

The U S Government Plans To Slice 7 500 Off Electric Car Prices But It S Complicated The Autopian